Navigating a Client's Marine risks can be challenging

Maritime activities cover a wide range of risk exposures and unique operations that only a Marine General Liability policy can properly address. Crafting a suitable program requires working with a business partner that understands. Let ISC experts work with you to remove the guesswork and develop the best solution.

MARINE LIABILITIES

Marine Liability combines coverage found in a commercial general liability (CGL) with coverage provided by a marine liability policy. To be eligible, 80% of the Insured’s receipts must be derived from marine operations. The Policy(ies) can be tailored to cover a wide range of exposures. Many Insureds require more than one of the coverage classes outlined below.

Limits

- $1MM Primary Limit for any one occurrence

- $2MM General Liability Annual Aggregate

- Coverage includes Personal/Advertising Injury, Products and Completed Operations

Types of Operations & Coverage Details

Ship Repairer’s / Marine Construction / Marine Contractor’s Legal Liability

Covers vessels while in the care, custody, and control of the Insured. Coverage is available for work being performed at the Insured’s premises as well as work performed at off-site customer locations.

- Electronics installation onboard a vessel

- Furniture installation/repair onboard

- Ship/Engine repairs

- Kitchen (galley) repair

- Vessel cleaning/detailing

- Dock Builder's

Wharfinger’s (aka Landing Dock) Legal Liability

Covers damage to non-owned vessels while in the Insured's care, custody, and control.

- Tug & Barges

- Coverage is also provided if vessels are being moored at the facility for an extended period

- Vessels utlilizing an Insured's dock to pick up or discharge passengers

Terminal Operator’s Legal Liability

Covers non-owned cargo moving through the Insured’s facility(ies).

- Smaller regional facility handling a few customers or specific commodities

- Large high-volume port facility (e.g. Port of Newark)

Charterer’s Legal Liability

Covers the liabilities associated with operating a 3rd-party vessel/watercraft charted by the Insured.

- Can be written as voyage or time-charter

- Similar in concept to a car rental agreement

Stevedore’s Legal Liability

Covers the liabilities associated with the loading/unloading of non-owned vessels.

- Loading or unloading of cargo

- Stacking and storing of cargo on a wharf

- Receiving and/or delivering cargo within a terminal or facility

Excess Liabilities

Provides protection over primary marine liability coverage on a following form basis.

- Minimum attachment point is excess of $5MM

- $10MM maximum

- Ability to write multiple layers on a single program

- Can offer excess over ISC primary policy, subject to minimum attachment point of $5MM

- HAVE BAR GRAPH EXAMPLE OF LAYERS

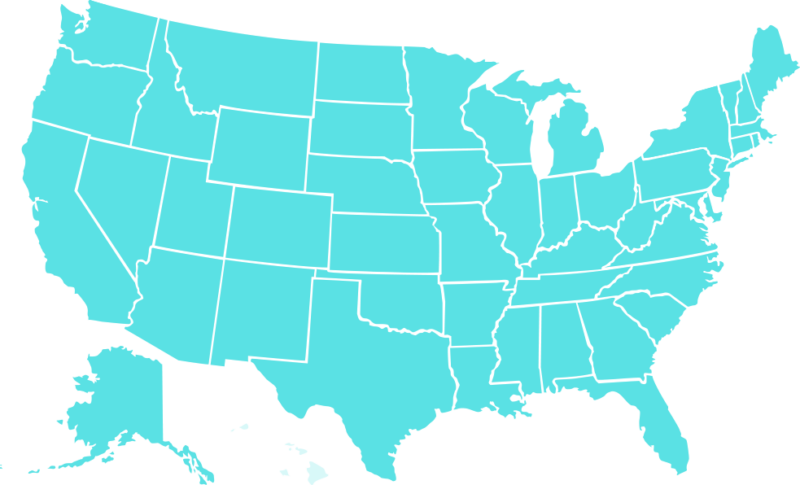

Geographic Scope

-

Continental United States

In-Appetite Risk Examples

- Marine Contractors

- Commercial Shipyards

- Off-site vessel repairs

- Small/midsize dock builders

- Vessel Operators

Excluded Risks

- Product Manufacturers

- Marinas

- Excess placements with less than $5,000,000 in underlying coverage

Find yourself in unfamiliar waters?

We welcome the opportunity to discuss any specific, or general, questions you may have regarding marine insurance. Give us a ring:

Marquam Wolfe (973) 997-2307

John Kiernan (516) 551-7403

Kevin Wolfe (973) 875-3361

Get In Touch